Payroll outsourcing & 4 Major insurances

What is payroll outsourcing?

Law& operates a professional and systematic payroll management system based on the 4 major insurance laws.

We have differentiated expertise by in-depth research on all laws and regulations in relation to payroll outsourcing, based on which we can prevent problems in advance as well as increase employees' trust in the company.

Needs for payroll outsourcing

-

1. Provision of professional services

Considering that calculation and settlement of salary, and deduction of

four major insurance premiums, etc. must be clearly and transparently

conducted in accordance with labor-related laws and regulations,

Law & promises to provide differentiated professional services. -

2. Securing work efficiency and reducing costs

By outsourcing work that one personnel should be fully responsible for to

a specialized agency, companies may be able to secure core work concentration

and work efficiency, and to reduce maintenance costs charged for systems

such as payroll management programs as well as personnel expenses. -

3. Securing confidentiality on annual salary

By minimizing access to salary-related information

within the company except for the company's

payroll personnel, the effectiveness of confidentiality

can be increased. -

4. Securing a history of payroll management

Companies may be able to minimize the possibility of problems such as

omission of takeover even when the company's payroll personnel changes

his/her position or quits his/her job and by doing so,

prevent errors or omissions in payroll work.

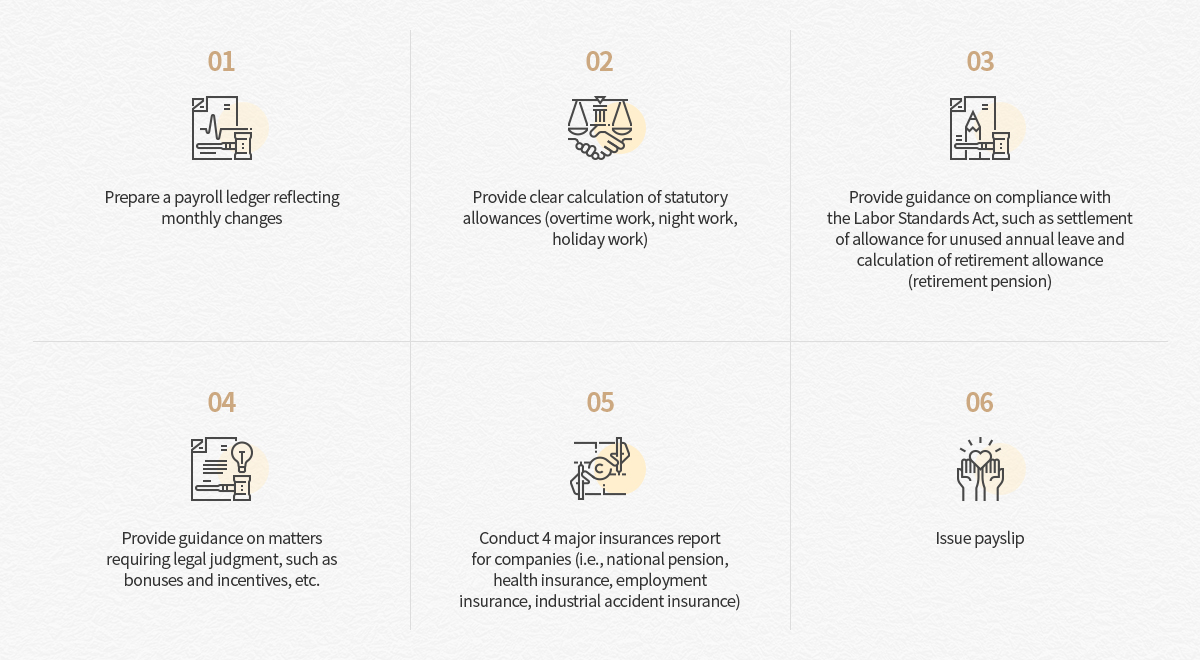

Payroll outsourcing services