Substitute payment / Small substitute payment

What is substitute payment / small substitute payment?

There might be cases in which employees are not paid the contractual wages, etc. even though they have provided work to the company.

In this case, an employee can resort to the substitute payment system by proving management difficulties that the company has reached judicial bankruptcy such as corporate rehabilitation or bankruptcy, or a similar situation in fact. In addition, in case of general overdue wages, an employee can use the small substitute payment system by proving the fact of overdue wages.

Necessity of representation in substitute payment / small substitute payment cases

In relation to the use of the substitute payment system, there is a difficulty in proving the fact

that the company is actually in a state of bankruptcy due to significant management difficulties,

and it is also difficult to prove that the overdue wages are the wages subject to the substitute payment

Law & is commissioned by the parties in this difficult situation and works to find out the substantive

truth based on the preempted expertise so that the parties can effectively secure the right to claim the payment of arrears.

Law& represents a party in this difficult situation with a mandate from the party, and based on

differentiated expertise preemptively possessed, it conducts the task of effectively ensuring

the right to the substitute payment of the party by finding the substantial truth.

Possible claim amount of substitute payment / small substitute payment

-

A. General substitute payment

The substitute payment shall be the unpaid amount of wages or shutdown allowances

for the last three months and retirement benefits for the last three years, subject to the upper limit below.

The current upper limit amount for the monthly fixed substitute payment (from January 1, 2014)Item Age at the time of retirement Under 30 30 to under 40 40 to under 50 50 to under 60 Over 60 Wages and retirement benefits 1.8million won 2.6million won 3million won 2.8million won 2.1million won Shutdown allowances 1.26million won 1.82million won 2.1million won 1.96million won 1.47million won ※ Wages or shutdown allowances shall be based on one month payment, and retirement benefits shall be based on one year payment.

※ The above-mentioned upper limit amount for the monthly fixed substitute payment shall be applied to the cases where the date of application for admission

of facts such as the date of declaration of bankruptcy, the date of the decision to commence rehabilitation, or the date of insolvency is after January 1, 2014.

※ The substitute payment to be paid shall be the smaller amount between the unpaid amount of wages and shutdown allowances for the last three months and retirement benefits for the last three years, and the “upper limit amount for the monthly fixed substitute payment”, based on which the current maximum amount of the substitute payment for an employee (assuming the age of 40 or more and less than 50) shall be 18 million won (3 million won x 6 (3 months' wages + 3 years' retirement benefits)). -

B. Small substitute payment

The small substitute payment shall be up to 10 million won of the unpaid amount of wages or shutdown allowances for the last three months and retirement benefits for the last three years; the upper limit for each item is set at 7 million won by dividing the items into [wages and shutdown allowances] and [retirement benefits]

Item Upper limit amount Total upper limit amount 10 million won Wages (Shutdown allowances*) 7 million won Retirement benefits 7 million won ※ Shutdown allowances shall be combined with wages, and the upper limit is set at 7 million won.

⇒ According to the enforcement of the revision of 「Notification of the upper limit amount for the substitute payment 」 (The Ministry of Employment and Labor Notification No. 2019-31, September 7, 2019), it shall be applied from the first case that receives a final civil judgment, etc., after July 1, 2019.

※ If the date of confirmation of the right of execution, such as a judgment, is before June 30, 2019, the upper limit amount of the small substitute payment shall be up to 4 million won even if a request for payment of the small substitute payment is made after July 1, 2019.

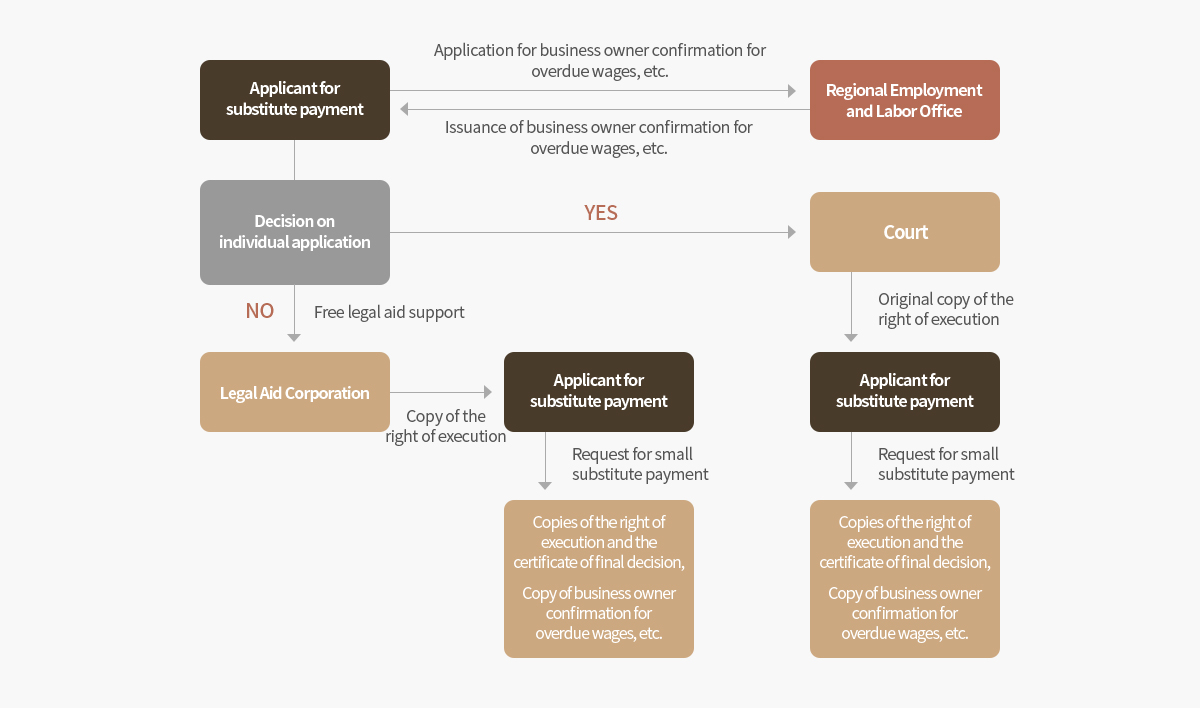

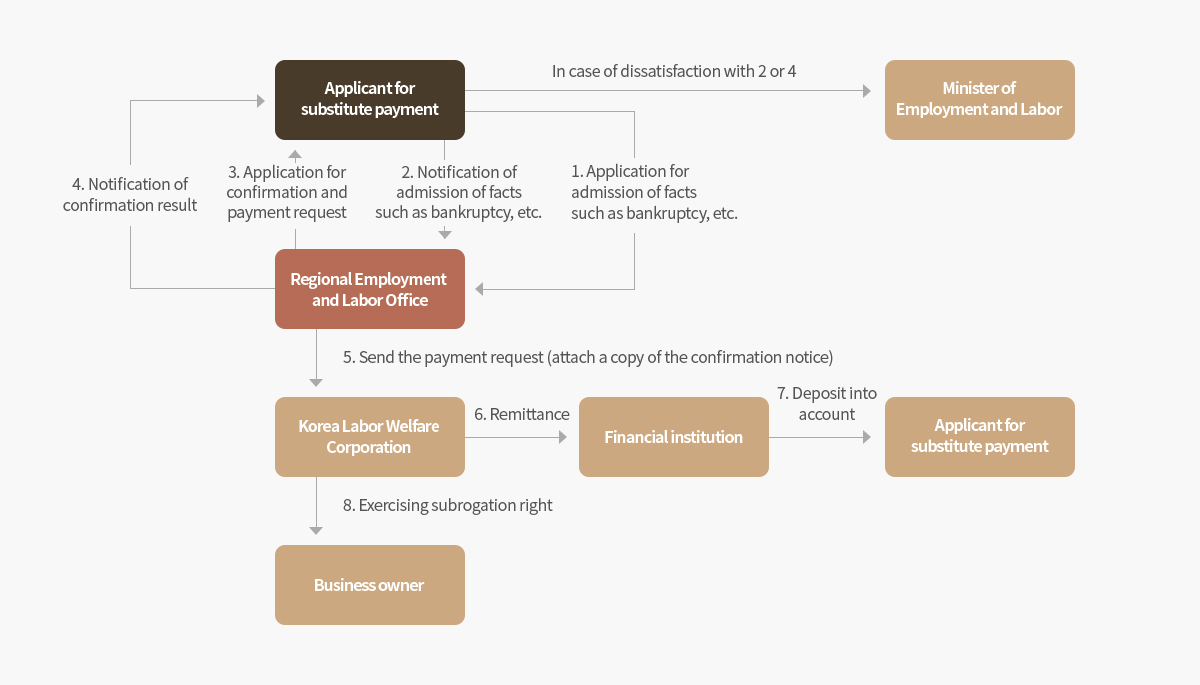

Procedure for substitute payment

Flow chart of application and payment for substitute payment (Admission of facts for bankruptcy, etc.)

Flow chart of application and payment for small substitute payment